不管中国经济增速怎么放缓或者股市怎么暴跌,中国消费者也不会很快停止洗衣服或者吃杯面。

但生产快速消费品的跨国企业发现,现在更难依赖中国来弥补其他地区的销售疲势了。

零售业分析师表示,甚至在股市最近这轮震荡之前,快速消费品销量增速就已出现大幅下滑,而股市震荡可能会加剧销量放缓。

在中国本土品牌抢夺从牙膏到果汁等各种快速消费品的市场份额之际,跨国消费品公司发现竞争难度加大,特别是在占据该行业很大比例增幅的二三线城市。

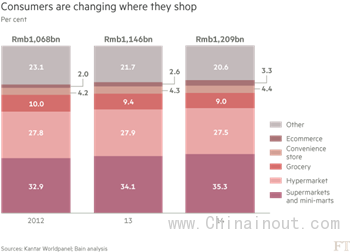

贝恩咨询公司(Bain & Co)和凯度(Kantar)编制的一份报告称,以价值计,中国快速消费品市场同比增速从2012年的近12%降至今年第一季度的4.4%。

2014年的快速消费品销量几乎与2013年持平,平均售价则上涨5.4%,是通胀率的两倍多。

关注零售业的咨询公司博楷咨询(Kurt Salmon)驻上海合伙人陈科表示:“经济放缓是导致该行业销量放缓的主要因素。”

今年6月,中国内地汽车销量下滑,这是近两年来的首次,汽车制造商也把这归咎于经济增速放缓。

贝恩咨询大中华区消费品业务合伙人布鲁诺拉纳(Bruno Lannes)表示:“对于快速消费品品牌而言,中国市场的竞争格局与其他市场截然不同。在销量增长或价格溢价的优势消失以后,快速消费品公司正在探索新的竞争模式。”

据贝恩咨询称,2014年,外国品牌在华市场占有率连续第三年下滑;对个人护理、家庭护理、饮料和包装食品这4大消费品领域中的26个品类的调查发现,本土竞争对手在18个品类市场份额上升。

贝恩表示,本土品牌占有这些品类约70%的市场份额,消费品市场出现的增长也主要归属于本土品牌。(www.chinainout.com)

No matter how much China’s growth might slow or its stocks stumble, the country’s consumers will not stop washing their clothes or eating cup noodles anytime soon.

But multinational makers of fast-moving consumer goods are finding it harder to rely on China to take up the slack for other regions.

Growth in sales of necessities has tumbled, even before the latest market gyrations, which could exacerbate the slowdown, retail analysts say.

With local brands grabbing share for items from toothpaste to fruit juice, multinational consumer companies are finding it harder to compete, especially in lower-tier cities that account for much of the growth in the sector.

Growth in China’s FMCG market by value has slowed from nearly 12 per cent in 2012 to 4.4 per cent in the first quarter of 2015 year on year, according to a report by Bain & Co and Kantar.

FMCG sales volume was flat in 2014 compared with 2013, while average prices rose 5.4 per cent — more than twice the rate of inflation.

“The economic slowdown is the main factor triggering the decline,” says Chen Ke, partner at retail consultancy Kurt Salmon in Shanghai.

Mainland car sales fell in June for the first time in nearly two years, with carmakers also blaming slowing economic growth.

“It’s a different game for FMCG brands in China,” says Bruno Lannes, a partner in Bain’s China consumer products practice. “Without the advantages of volume growth or premium pricing, FMCG companies are seeking new ways to compete.”

Foreign brands lost market share in 2014 for the third year in a row, according to Bain, with local rivals gaining share in 18 of the 26 categories surveyed for the report, including the four largest consumer goods sectors: personal care, homecare, beverages and packaged food.

Domestic brands account for about 70 per cent of the market in those categories, Bain says, adding that what growth did occur in the sector primarily went to local brands.